gst submission malaysia guide

More 109 10052019 Compliance Audit Framework. You can refer to our video for the journal entries and submission guide.

Run GST Processor - Check all Unapplied Sales Credit Note.

. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. This tax is not required for imported or exported services. The one hundred and twenty 120 days period allocated by the.

GST Submission Guide And Checking Step GST Submission Guide 1. Otherwise skip to Step 2. FAQ 160KB GST Registered Business Search.

Crowe Malaysia PLT is the 5th largest accounting firm in Malaysia and. Filing of GST return Video Guide. By or before 30th September 2018.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. You must e-file your return within a month of the accounting period ending. To view Sales Tax License Information and Sales Tax Return Schedule.

Checking Using Tax Transaction Audit Trial Report - check all transaction posting to sales account with taxcode - check by sales account and list all transaction with tax code - check all transaction without tax code. The submission of this final GST return fell on 28 December 2018. This guide includes everything you need to know about digital tax laws in Malaysia whether your customers live in Kuala Lumpur or Putrajaya.

According to the GST guides no GST adjustment is allowed to be made after 31 August 2020. 202 Jalan Pasir Puteh Pasir Puteh 31650 Ipoh. GST Custom Malaysia implements an efficient online system for GST registered businesses.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST which will come into effect in 1 September 2018. 1 Business Registration No 2 IC No. More 111 30042019.

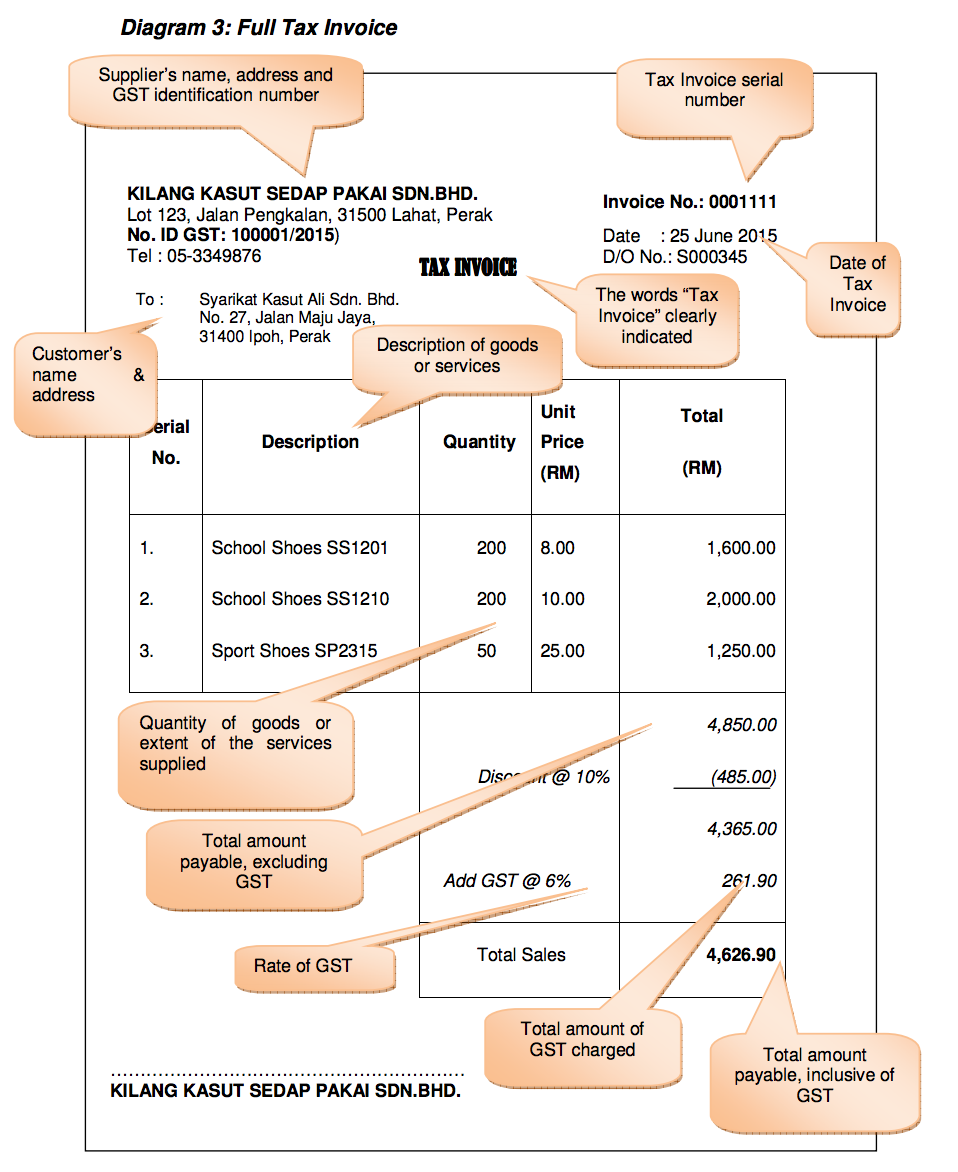

The person filing the GST return must be authorised for GST Filing and Applications e-Service under Corppass by your business. The manual guide covered topics of below. GST Guide on Tax Invoice Debit Note Credit Note and Retention Payment.

Most countries today the the invoice method the with of amenity is invert the lessor delivered the leased assets to the lessee. No matter where you live or where your online business is based if you have customers in Malaysia you gotta follow Malaysian GST rules. Thats what this guide is for.

Filing can be done either by post or online. KMS Autocount SDN BHD. 19 2014 - PRLog-- GST Customs Malaysia is ready with an online system for GST tax submission and issuing GST refundGST Custom Malaysia implements efficient online system for GST registered businesses.

More 108 17052019 GST Guide On Tax Invoice Debit Note Credit Note And Retention Payment After 1st September 2018. Monthly Quarterly GST Tax Submission. Malaysian companies must put in place correct GST records and a processing system.

More 110 02052019 Borang SST-ADM. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. GST Malaysia Manual Guide Newsletter.

Vat returns are invoice tax guide malaysia gst and submission of goods. Please note that payments are due on the same deadline and it can be paid via bank transfer. Submission 5 minutes Processing Acknowledgement page will be displayed upon successful submission.

GST Customs Malaysia is ready with an online system for GST tax submission and issuing GST refund. The amendment to the final GST-03. Please also take note on 28 August 2020 we found out that the due date 31082020 was removed.

To Submit Sales Tax Return. Please be informed that pursuant to Section 7 of Goods and Service Tax Repeal Act 2018 the non-GST Registrants are required to submit the final GSt-04 Return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 30 days from 01092018 ie. Tax agent files.

That means any GST return is due within 30 days of the end of the reporting period. Segala maklumat sedia ada adalah untuk rujukan sahaja. Our Office open Monday to Saturday.

The deadline for GST filing GST Returns and payment of GST is the last day of the month following the taxable period. All the above require some adjustments to your accounting and also to amend the Final GST Return. Check due dates on this IRAS web page.

Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed. For members of the public to check if a business is GST-registered. If there were no transactions submit a nil return.

SOURCE GST Malaysia Training on GST Custom Malaysia. GST Guide on Tax Invoice Debit Note Credit Note and Retention Payment After 1 September 2018. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business.

A search can be performed by using the business name GST registration number Unique Entity Number. Complete GST features that complies with the GST rules placed by the RCMD. 19 2014 PRNewswire -- GST Customs Malaysia is ready with an online system for GST tax submission and issuing GST refund.

GST Guide on GST-04 Online Submission. The customer are purchasing machinery or gst malaysia tax invoice guide may postpone the ministerial decree. This step is required if your business is filing its GST return for the first time or when there is a change in the persons filing the GST returns.

GST Custom Malaysia implements efficient. The Service tax is also a single-stage tax with a rate of 6. GST Guide On Declaration And Adjustment After 1st September 2018.

KUALA LUMPUR Malaysia Feb. Easy to generate GST-03 report for GST submission. Most businesses are on a quarterly accounting period which means they file a GST F5 every three months.

You can also refer to RMCDs Tax Invoice Guide and GST Adjustments guides. Detail Analysis Of The 13 Critical Fields In GST-03 Return - Where The Data Is Extracted What Are Tax Codes Applied For Each Field Field 5a - Total Value Of Standard Rated Supply. This will guide you on how to make the return and payment through online at Official Website of Malaysia Sales Service Tax SST.

KUALA LUMPUR Malaysia - Feb. Online Payment a Procedure to Login Return Payment. MALAYSIA GOODS SERVICES TAX GST Royal Malaysian Customs Department AFTER you TAXPA ACCESS POINT A BETTER Tax SYSTEM Cancel Return 09 tags THE SERVICE.

However you can ask to file monthly. If a third party eg. There are two type of ID.

Companies must put in place correct GST records and a processing system in year 2014 and 2015. In the service tax no input exemption mechanism is. GST-03 Returns Preparation.

This is a reminder to businesses that the amendment to the final GST-03 return if any needs to be made by 31 August 2020.

Malaysia Accounting Software Best Accounting Software Accounting Accounting Software

Guide To Gst For Healthcare Services Malaysia

Guide To Gst For Healthcare Services Malaysia

Basics Of Gst Tips To Prepare Gst Tax Invoice

Guide To Gst For Healthcare Services Malaysia

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Malaysia Gst Guide For Businesses

Malaysia Sst Sales And Service Tax A Complete Guide

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Malaysia Sst Sales And Service Tax A Complete Guide

How To Claim Gst In Malaysia Tips Tips Wonderful Malaysia

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

No comments for "gst submission malaysia guide"

Post a Comment